Revolutionizing Remittances: How Blockchain Technology Impacts Cross-Border Peer-to-Peer Payments

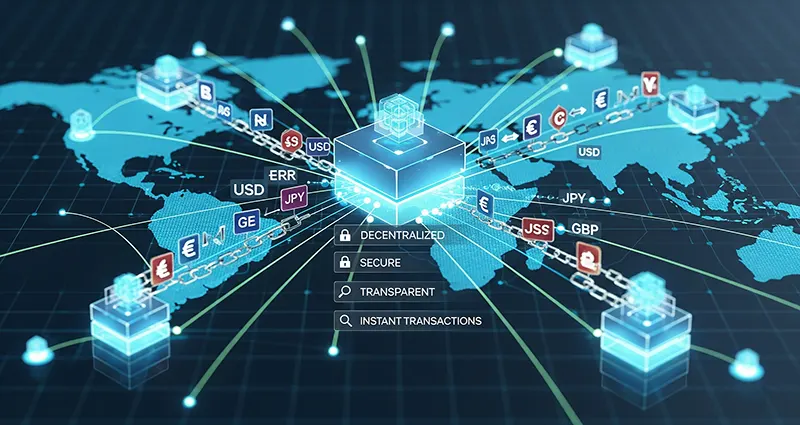

Cross-border peer-to-peer (P2P) payments, often synonymous with remittances, have long been a cornerstone of global economies, enabling individuals to send money to family and friends across international borders. However, this vital process has historically been plagued by inefficiencies: high transaction fees, slow processing times, opaque exchange rates, and a lack of accessibility for unbanked populations. Enter blockchain technology, a disruptive force poised to fundamentally transform how cross-border P2P payments are conducted.

Blockchain, the decentralized and immutable ledger system famously underpinning cryptocurrencies like Bitcoin, offers a compelling solution to many of the long-standing challenges in the remittance landscape. Its inherent characteristics directly address the pain points of traditional money transfer systems, paving the way for a more efficient, equitable, and accessible future for global payments.

The Traditional Landscape: A Web of Intermediaries

Before delving into blockchain’s impact, it’s crucial to understand the traditional remittance ecosystem. When an individual sends money internationally … READ MORE ...