Personal finance apps have moved beyond simple budgeting tools to become a central component of how an entire generation manages its money. For Gen Z and millennials, these apps are not just about tracking expenses; they are a gateway to financial literacy, a community platform, and a personalized guide to a complex financial world. As a result, the next wave of personal finance apps is being shaped by the unique behaviors and priorities of these digital-native generations.

1. Gamification: Making Financial Goals Fun

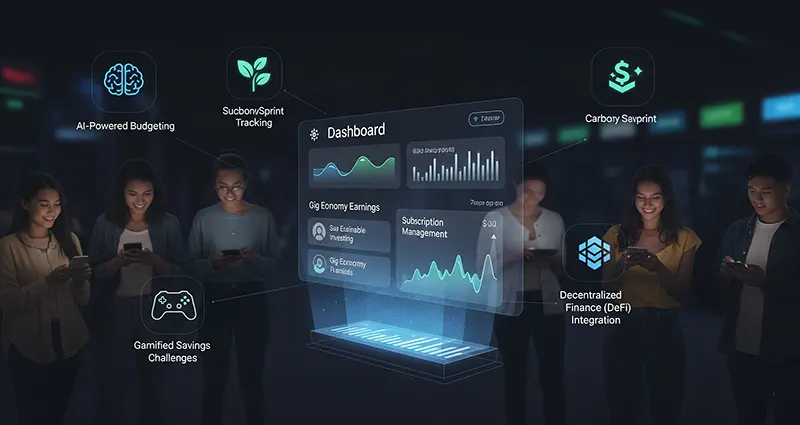

Gen Z and millennials have grown up with video games and social media, and they expect their financial tools to be just as engaging. The future of personal finance apps will be heavily influenced by gamification—the integration of game-like elements to make a task more enjoyable and motivating.

- Points and Badges: Apps will reward users with points, badges, and virtual currency for achieving financial milestones, such as setting up a budget, paying off a credit card, or making a recurring savings contribution.

- Challenges and Quests: Users will be able to join “challenges” to save for a specific goal (e.g., a vacation) or pay down a debt. These challenges will have clear progress bars and celebratory messages to keep users engaged and motivated.

- Competitive Leaderboards: Social features will allow friends to compete on leaderboards for who can save the most or stick to their budget, turning a solo task into a communal, competitive activity.

2. The Rise of AI and Hyper-Personalization

While many personal finance apps already use AI for basic expense categorization, the next generation will use AI to provide truly personalized and proactive financial guidance.

- Real-Time Coaching: AI will serve as a personal financial coach, offering instant, actionable advice based on a user’s real-time spending habits. For example, an app might send a gentle nudge like, “You’ve spent 70% of your food budget this week. Consider cooking at home for the next two days.”

- Predictive Insights: AI models will analyze spending patterns to predict future financial challenges and opportunities. For instance, the app could predict a user might overspend on entertainment next month and suggest a proactive adjustment to their budget.

- Automated Financial Planning: For those without access to a human financial advisor, AI-powered platforms will be able to create and manage investment portfolios, help with retirement planning, and even offer tax-saving strategies tailored to individual goals and risk tolerance.

3. Social Integration and Community Building

For Gen Z and millennials, money is not just a private matter; it’s a topic of public conversation on social media. This has led to a growing demand for social features within personal finance apps.

- Peer-to-Peer Payments as a Social Experience: The success of apps like Venmo, with its public transaction feed, has shown that young people view payments as a social activity. Future apps will build on this by integrating features that allow users to share financial wins, celebrate milestones, and even engage in friendly competition.

- Community-Based Learning: Apps will feature forums or social feeds where users can ask questions, share tips, and learn from one another’s financial journeys. This peer-driven education can be more effective and relatable than traditional financial literacy content.

- Influencer and Creator Content: Just as young people turn to TikTok and YouTube for financial advice, future apps will likely integrate content from verified “FinTok” and “Finfluence” creators, providing bite-sized, engaging financial education directly within the platform.

4. Beyond Budgeting: A Holistic Financial Hub

The future of personal finance apps will be less about managing a budget and more about managing a holistic financial life.

- Micro-Investing: Already popular, micro-investing features (like rounding up purchases and investing the change) will become more sophisticated, integrating with a user’s spending to make saving and investing an automated, seamless part of daily life.

- Credit Building and Management: Apps will offer more than just credit score tracking. They will provide clear, actionable steps to build credit, manage debt, and even dispute errors, making the process transparent and less intimidating.

- Unified Financial View: Users will expect a single platform that consolidates all their financial data—from bank accounts and credit cards to crypto wallets and student loans—providing a single source of truth for their entire financial picture.

By leaning into gamification, leveraging AI for personalization, fostering social communities, and offering a comprehensive suite of tools, personal finance apps are evolving from simple trackers into empowering financial partners. They are not just helping Gen Z and millennials manage their money; they are helping them build confidence, achieve their goals, and navigate a complex economic landscape on their own terms.